CenterSquare Launches Essential Service Retail Joint Venture

December 19, 2024 – CenterSquare Investment Management (CenterSquare) today announced a joint venture (JV) partnership with one of the country’s largest state pension funds. The JV is focused on institutionalizing the niche Essential Service Retail (ESR) sector and seeks to acquire 30 to 40 properties by late 2026.

CenterSquare’s ESR strategy invests in e-commerce-resistant, high-quality service retail properties that meet specific investment criteria at attractive pricing. Utilizing a data-driven approach, CenterSquare’s ESR team identifies and invests in neighborhood shopping centers located in high-growth markets. These centers offer essential services, including food and beverage, fitness, beauty, health and medical, and business services to the public. ESR tenants are regional and national brands whose customers must physically visit the store to consume the service or product.

CenterSquare’s existing ESR portfolio currently spans more than 50 properties across the United States. With this new programmatic joint venture, CenterSquare will seek to nearly double the size of its ESR portfolio over the next two years.

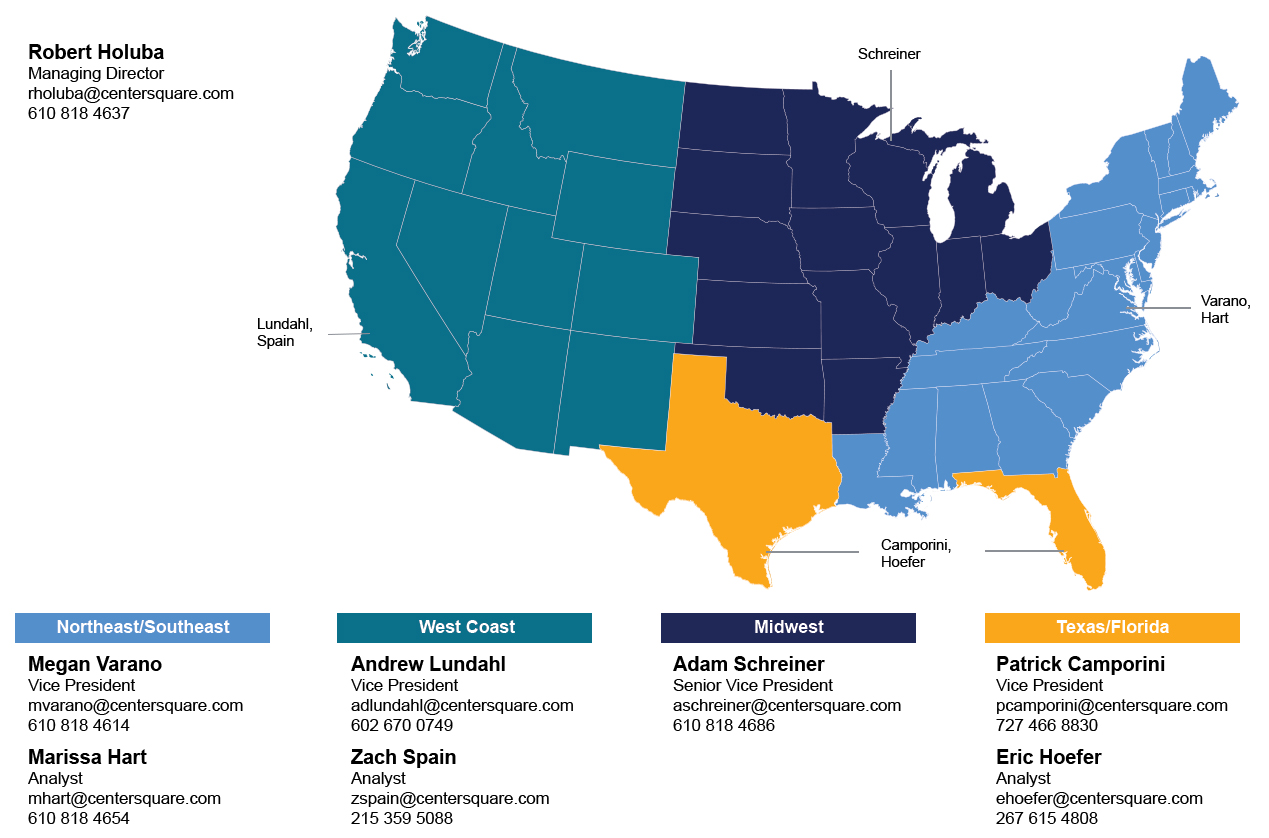

Please reach out to the contacts included below with opportunities or questions.