REIT Insights: The Goldilocks Interest Rate Zone

March 2025

REIT Insights

The Goldilocks Interest Rate Zone

The first two months of 2025 have seen plenty of volatility in the markets – both in terms of equities and rates – as expected. Despite the volatility in the 10-year U.S. Treasury yield, it has remained above 4%, which we believe will likely be the case for the foreseeable future, barring a meaningful economic downturn.

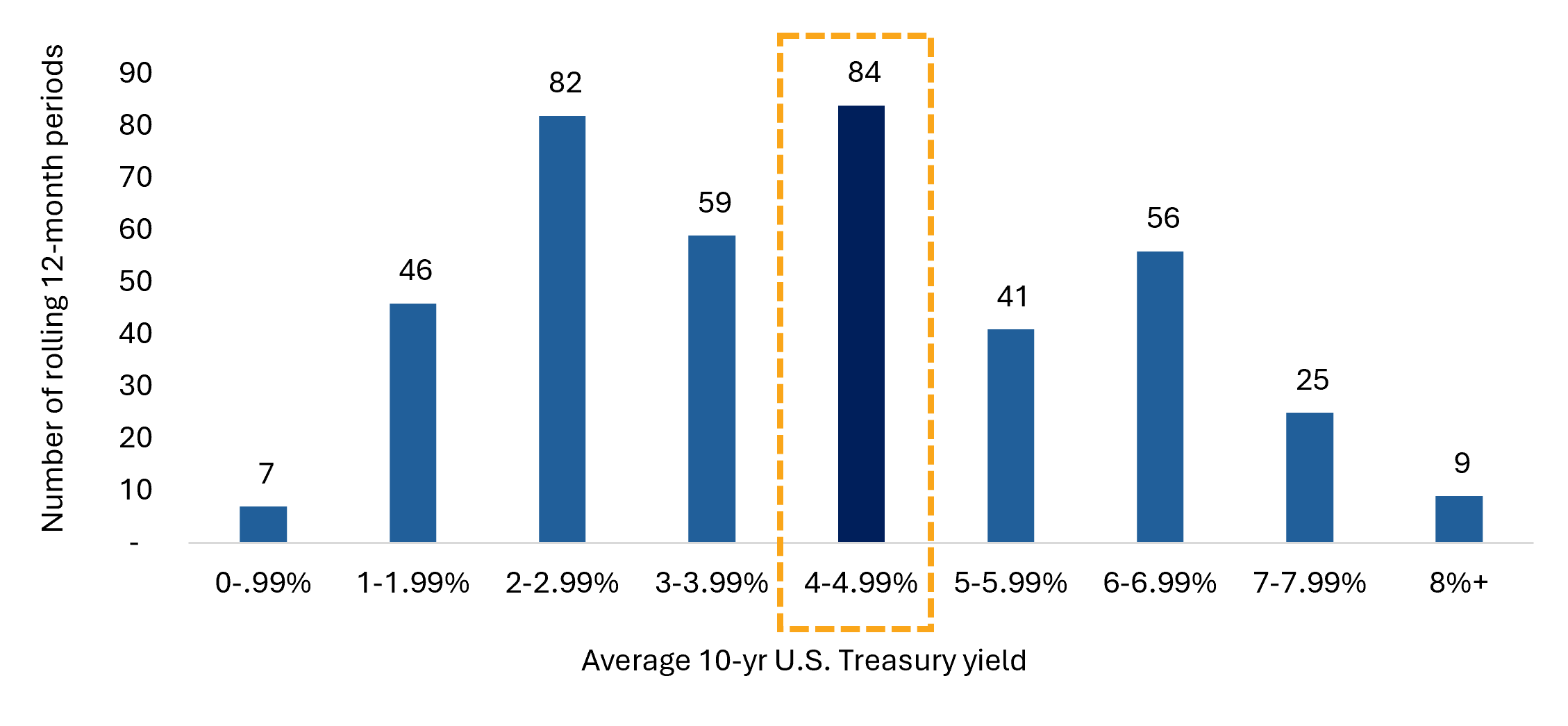

While this may screen as a “high” interest rate environment for many investors who have primarily been active in the market in the last 10 to 15 years, this environment isn’t so new to those who have invested through many market cycles. In fact, looking at rolling 12-month periods going back to 1990, it’s been most common to have interest rates between 4-5% (Figure 1).

Figure 1: Historical occurrences of interest rate

Source: CenterSquare Investment Management, Bloomberg, as of 2/27/2025.

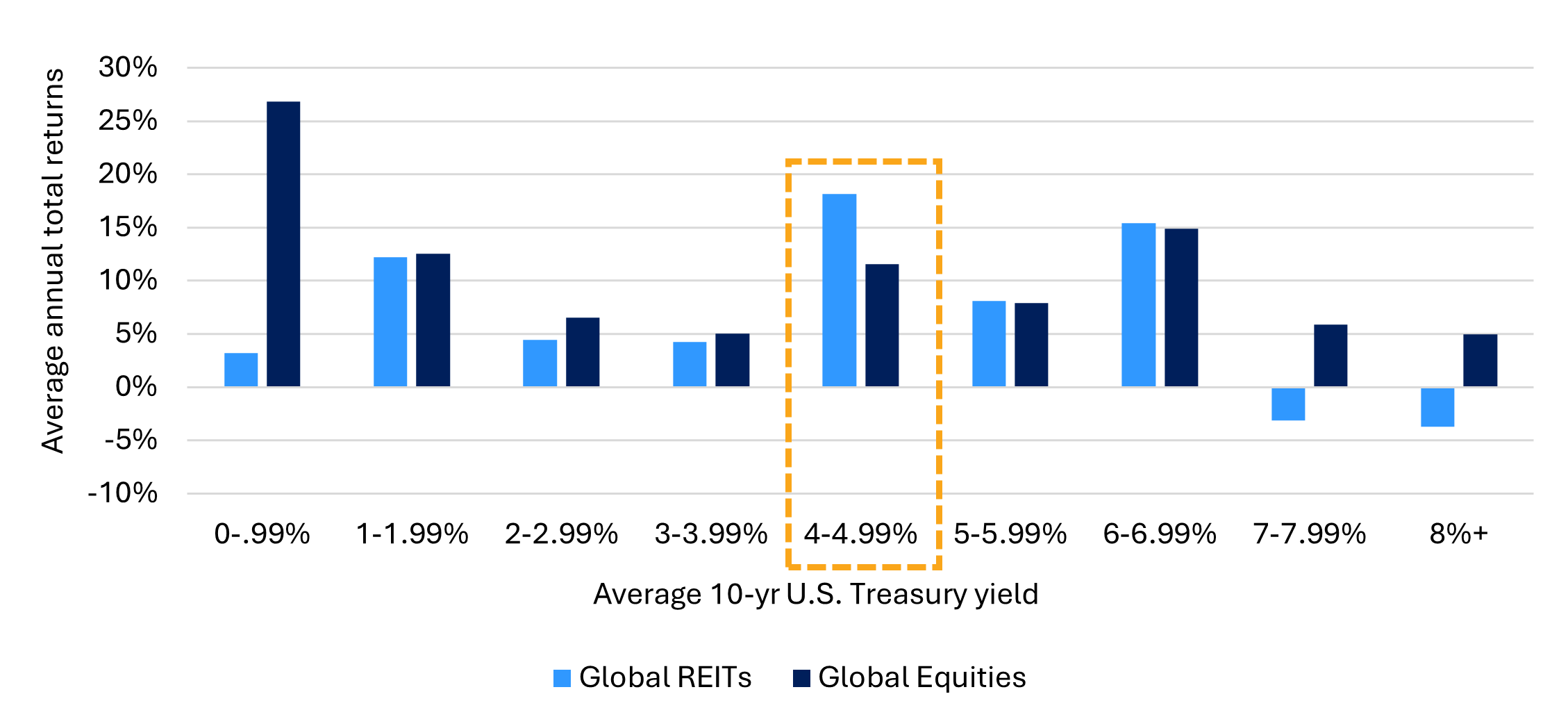

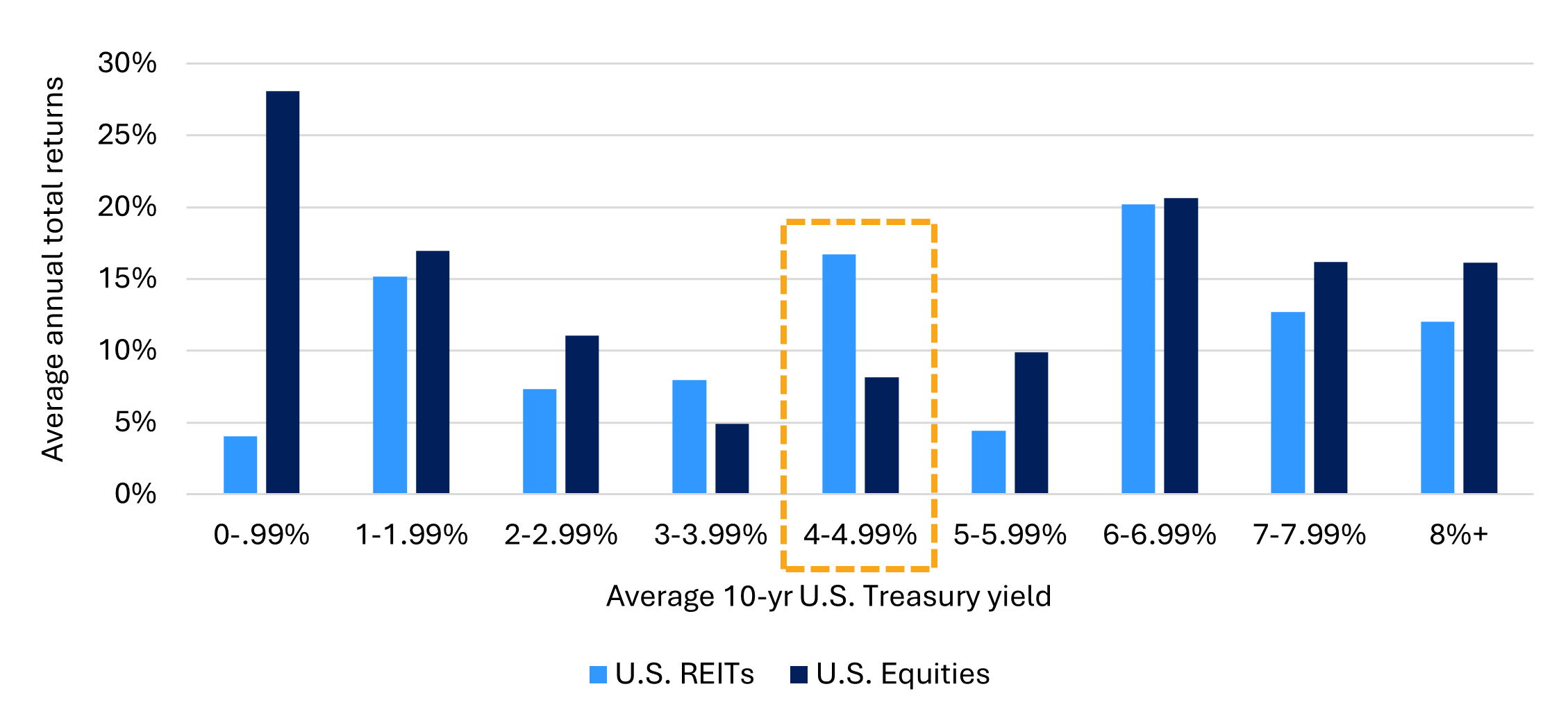

While the tightening monetary policy regime globally through 2024 created headwinds for the REIT market, REITs have historically outperformed broader equities in the U.S. and globally when the U.S. 10-year Treasury yields have been in the 4-5% range (Figures 2 and 3). Further, the largest underperformance of REITs versus broader equities has historically occurred when interest rates were extremely low, below 1%. Given the higher growth sectors, like technology, typically found across broader equities, it isn’t surprising that equities meaningfully outperform REITs in these environments where investors can discount future cash flows at a lower rate, justifying elevated valuations for equities.

Figure 2: Total returns for Global REITs and Equities during different interest rate regimes

Sources: CenterSquare Investment Management, Bloomberg, as of 2/27/2025. Global REITs = FTSE EPRA/NAREIT DEVELOPED Total Return Index USD, Global Equities = MSCI ACWI Gross Total Return USD Index.

Figure 3: Total returns for U.S. REITs and Equities during different interest rate regimes

Source: CenterSquare Investment Management, Bloomberg, as of 2/27/2025. U.S. REITs = FTSE Nareit Equity REITs Total Return Index USD, U.S. Equities = S&P 500 Total Return Index.

Despite the volatility in the market, the current backdrop with the 10-year U.S. Treasury yield in the 4-5% range, has historically proven to be a favorable environment for REITs around the world.

General Disclosures

Any statement of opinion constitutes only the current opinion of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.

Material in this publication is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security or commodity. Due to, among other things, the volatile nature of the markets and the investment areas discussed herein, investments may only be suitable for certain investors. Parties should independently investigate any investment area or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. Some information contained herein has been obtained from third party sources and has not been independently verified by CenterSquare Investment Management LLC (“CenterSquare”). CenterSquare makes no representations as to the accuracy or the completeness of any of the information herein. Accordingly, this material is not to be reproduced in whole or in part or used for any other purpose. Investment products (other than deposit products) referenced in this material are not insured by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by CenterSquare, and are subject to investment risk, including the loss of principal amount invested.

For marketing purposes only. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person. Any indication of past performance is not a guide to future performance. The value of investments can fall as well as rise, so investors may get back less than originally invested.

Because the investment strategies concentrate their assets in the real estate industry, an investment is closely linked to the performance of the real estate markets. Investing in the equity securities of real estate companies entails certain risks and uncertainties. These companies experience the risks of investing in real estate directly. Real estate is a cyclical business, highly sensitive to general and local economic developments and characterized by intense competition and periodic overbuilding. Real estate income and values may also be greatly affected by demographic trends, such as population shifts or changing tastes and values. Companies in the real estate industry may be adversely affected by environmental conditions. Government actions, such as tax increases, zoning law changes or environmental regulations, may also have a major impact on real estate. Changing interest rates and credit quality requirements will also affect the cash flow of real estate companies and their ability to meet capital needs.

Definition of Indices

FTSE EPRA / Nareit Developed Index (and FTSE EPRA/Nareit Developed Net Index)

The FTSE EPRA Nareit Developed Index is designed to track the performance of publicly listed real estate companies and REITs worldwide, containing eligible constituents from Developed markets as classified by FTSE Russell based on the nationality rules for FTSE EPRA Nareit Global Real Estate Index Series.

FTSE Nareit Equity REITs Index “FNRE”

The FTSE Nareit Equity REITs Index is a broad-based index consisting of real estate investment trust (REITs). This index excludes equity REITS that are designated as Timber REITs.

MSCI ACWI Gross Total Return USD Index

The MSCI ACWI Gross Total Return USD Index measures the performance of large and mid-cap stocks across 23 developed and 24 emerging markets, with gross dividends reinvested before tax deductions. This index provides a more complete picture of total returns by including dividend income, making it useful for performance benchmarking in a tax-neutral scenario.

S&P 500

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. It is not an exact list of the top 500 U.S. companies by market cap because there are other criteria that the index includes. Still, the S&P 500 index is regarded as one of the best gauges of prominent American equities' performance, and by extension, that of the stock market overall.

These benchmarks are broad-based indices which are used for illustrative purposes only and have been selected as they are well known and are easily recognizable by investors. However, the investment activities and performance of an actual portfolio may be considerably more volatile than and have material differences from the performance of any of the referenced indices. Unlike these benchmarks, the portfolios portrayed herein are actively managed. Furthermore, the portfolios invest in substantially fewer securities than the number of securities comprising each of these benchmarks. There is no guarantee that any of the securities invested in by the portfolios comprise these benchmarks.

Also, performance results for benchmarks may not reflect payment of investment management/incentive fees and other expenses. Because of these differences, benchmarks should not be relied upon as an accurate measure of comparison.

A direct investment an index is not possible.

FTSE Data disclosure: Source: FTSE International Limited (“FTSE”) © FTSE 2025. FTSE® is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.

"FTSE®" is a trade mark of the London Stock Exchange Group companies, "Nareit®" is a trade mark of the National Association of Real Estate Investment Trusts ("Nareit”) and "EPRA®" is a trade mark of the European Public Real Estate Association ("EPRA”) and all are used by FTSE International Limited ("FTSE”) under licence).

The FTSE EPRA/Nareit Developed Index is calculated by FTSE. Neither FTSE, Euronext N.V., Nareit nor EPRA sponsor, endorse or promote this product and are not in any way connected to it and do not accept any liability.

"FTSE®" is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited ("FTSE") under licence. "Nareit®" is a trade mark of the National Association of Real Estate Investment Trusts ("Nareit").

The FTSE Nareit Equity REITs Index is calculated by FTSE. Neither FTSE nor Nareit sponsor, endorse or promote this product and are not in any way connected to it and do not accept any liability.