2025 Market Outlook – Finding Sunny Skies in Cloudy Markets

January 2025

FINDING SUNNY SKIES

IN CLOUDY MARKETS

2025 MARKET OUTLOOK

Volatile and uncertain real estate markets have become familiar over the last few years amidst evolving capital markets and monetary policy, especially in relation to the cost and availability of debt capital. As we look forward to 2025, many of our base case assumptions remain consistent with the views we shared last year, but we anticipate broader acceptance of the market environment is likely to catalyze the beginning of a new real estate market cycle driven by:

-

- A new era of interest rates – a “higher for longer” interest rate environment for the long end of the yield curve, regardless of the impact of monetary policy on the short end of the yield curve.

- Survival of the fittest – the upcoming wall of debt maturities will finally unveil troubled real estate capital structures and generate opportunities for disciplined investors.

While this piece examines this macroeconomic environment, the rest of our 2025 outlook series will dive further into the niche real estate strategies we believe are likely to provide the most attractive risk-adjusted returns for real estate investors in the coming year across global listed REITs, non-core private equity, and enhanced income debt, as we look for sunny skies in the middle of a cloudy backdrop.

A new era

Though the Fed’s interest rate cuts had been a long-awaited catalyst for the listed REIT market, as real estate investors we have been keenly focused on the long end of the yield curve, namely, the 10-year treasury yield. While the Fed controls the short end of the yield curve, their actions have little to do with the 10-year treasury yield. In last year’s outlook, we explained our conviction behind an elevated 10-year treasury yield by dissecting the yield into its component pieces – inflation, real growth, and a term premium – and identifying upward pressure, particularly in inflation, due to structural changes within the economy. As we assess these components looking into 2025, our conviction is even stronger

Inflation

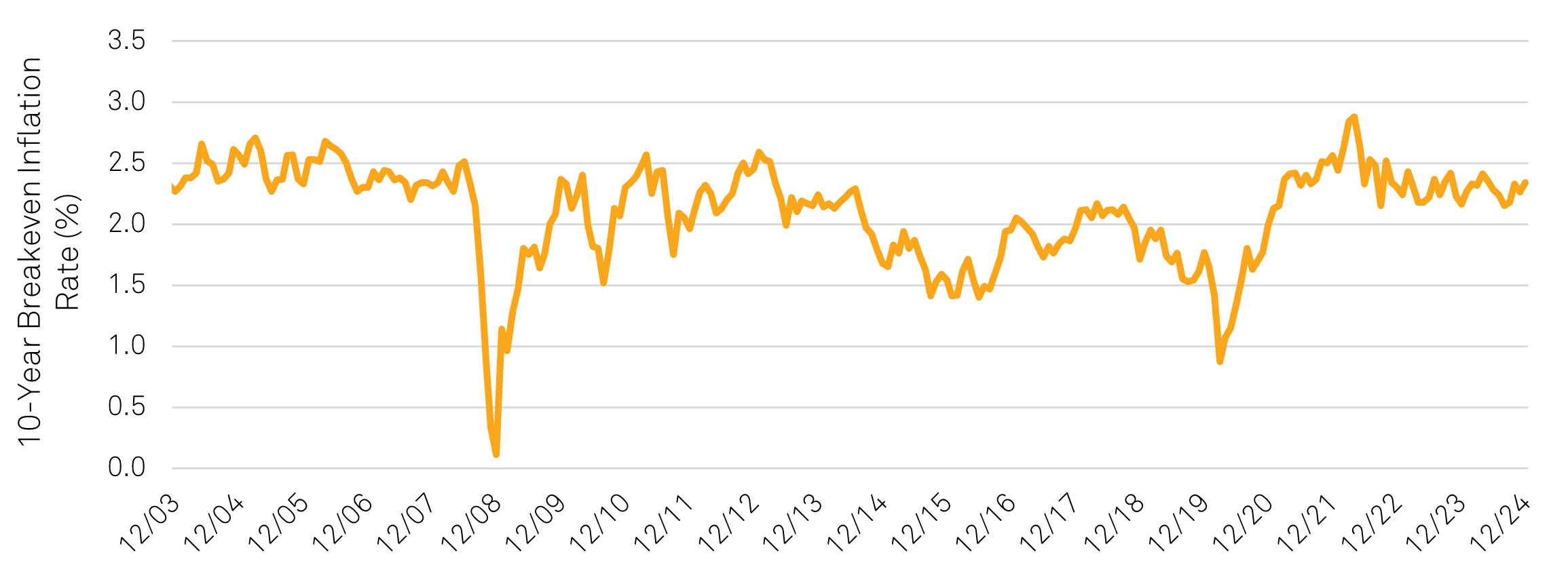

The case for stickier inflation has gained even more traction, particularly as it relates to the expectation for nationalistic policies from the incoming administration driving higher tariffs and tighter immigration policies reducing labor supply. Additionally, while elevated multifamily supply in 2024 pressured rent growth, we expect supply to decrease in the coming years, exacerbating the housing shortage. This shortage puts upward pressure on housing costs in the long-term, which is a meaningful component of inflation. While the expectation for inflation has been fairly range-bound since 2022 based on the 10-year breakeven inflation rate (Figure 1), it is finally capturing the attention of the broader market.

Figure 1: 10-year breakeven inflation rate

Source: Federal Reserve Bank of St. Louis, as of December 1, 2024.

Real Growth

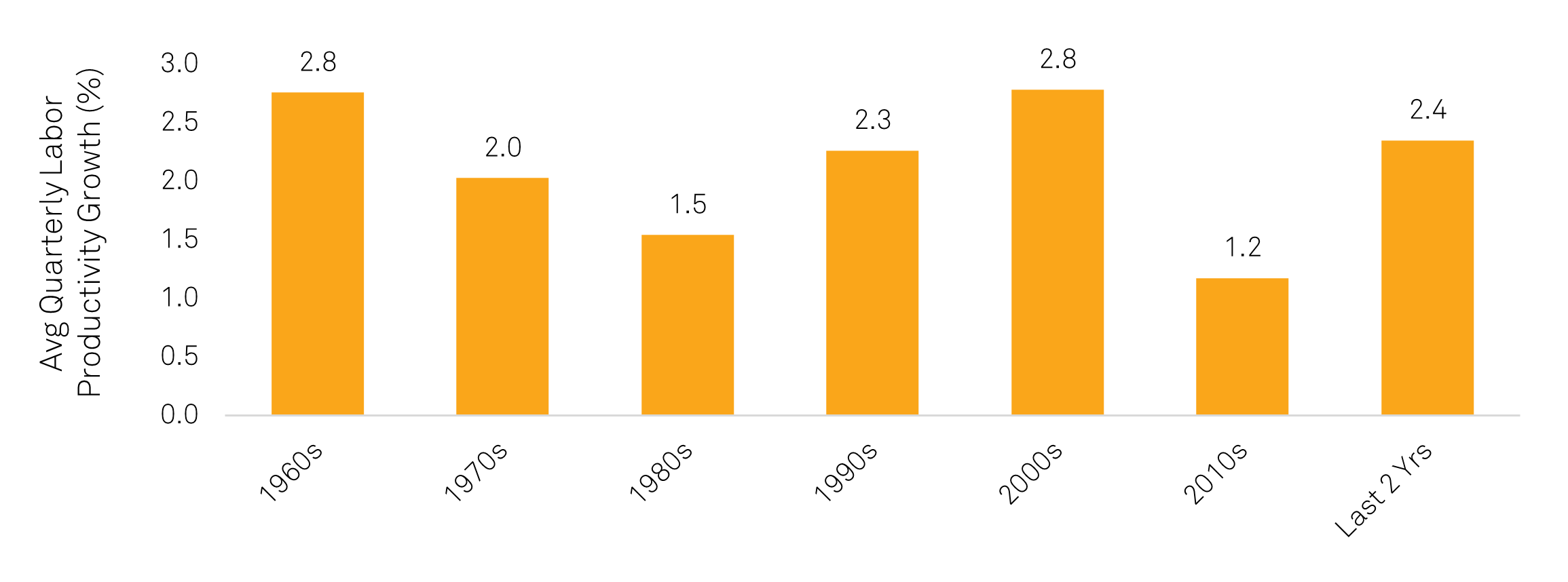

The economy has surprised investors to the upside in the last two years, and continued strong data have moved the market past the fear of recession. As such, the expectation for growth going into the new year is notably higher than it had been in the last two years, limiting the opportunity for an upside surprise. Additionally, growth could be materially impacted by competing forces based on the incoming administration’s policies in relation to immigration, tariffs, and government efficiency on one side with deregulation, tax cuts, and small business optimism on the other. While the policy environment is creating many uncertainties around growth in the coming year, there has been a positive, more structural impact on growth that is worth noting – the resurgence in productivity in the U.S. economy driven by the focus on automation and digitization, fueled by the pandemic and further accelerated by the focus on artificial intelligence (Figure 2).

Figure 2: U.S. labor productivity growth through prior cycles vs. last two years

Source: Federal Reserve Bank of St. Louis, as of July 7, 2024. Note: Nonfarm Business Sector: Labor productivity (output per hour) is real output divided by hours worked, including employees, proprietors, and unpaid family workers.

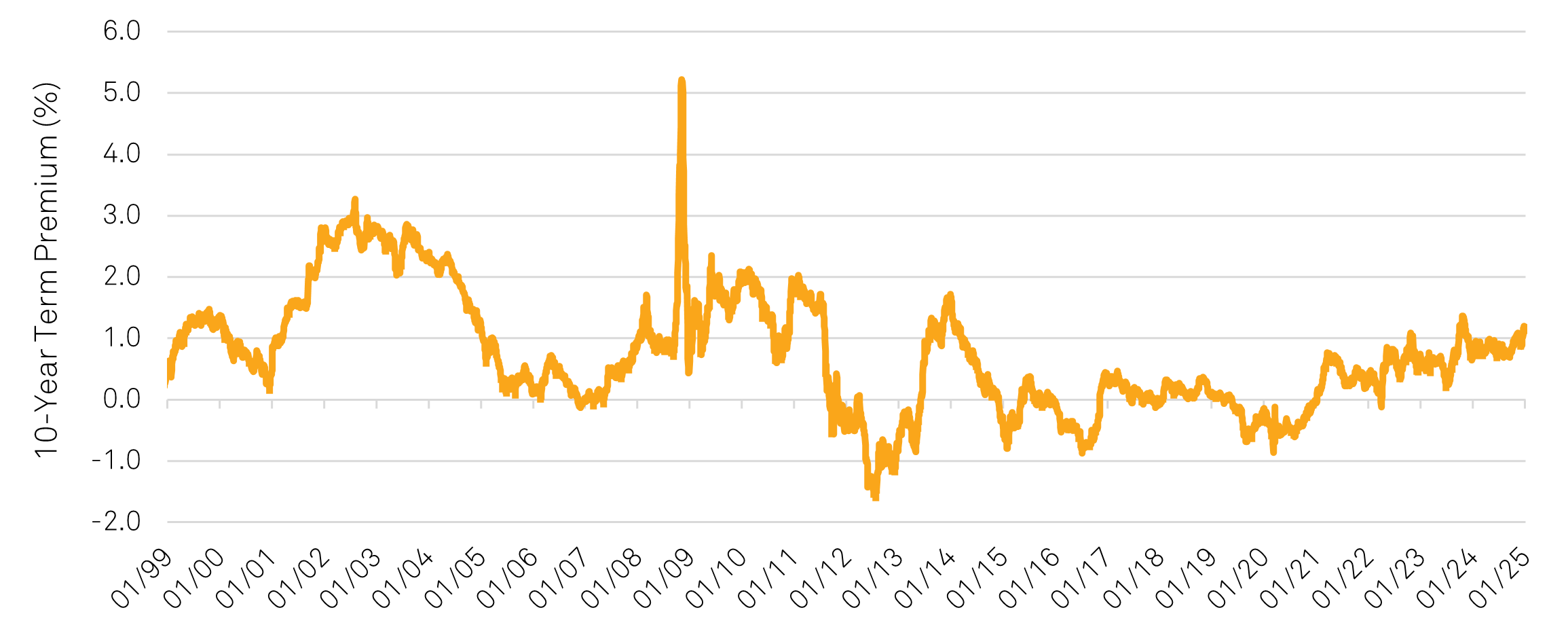

Term Premium

The steady rise of uncertainty driven by geopolitical tensions globally and increasing government debt is driving investors to seek higher returns for investing capital for longer periods. As such, we have seen a notable increase in the term premium in the last few years to over 100bps to start this year (Figure 3). Given the limited visibility into these overarching concerns and a lack of resolution on the horizon, we do not anticipate this trend in rising term premia to reverse in the coming year.

Figure 3: Term risk premium associated with 10-year Treasury yield

Source: Federal Reserve Bank of San Francisco, as of January 3, 2025.

Putting this together, we see continued upward pressure on inflation and heightened uncertainty around growth and long-term risks, creating a cloudy market environment for real estate investors. It also underpins our conviction that the 10-year yield should not structurally fall below 4% for the foreseeable future. Yields could fall if we see a meaningful recession in the U.S., which is not currently supported by economic data, or if lower growth globally results in lower yields globally, bringing capital flows to the U.S. as investors seek higher yields. This remains consistent with the views presented in our 2024 outlook, though it seems the broader market is slowly arriving at the same conclusion. Broader acceptance of the new reality of debt costs by buyers and sellers should result not only in increased transaction activity but will also uncover weak business models and capital structures unable to survive in this new reality, creating opportunities for disciplined investors.

Survival of the fittest

Excess money supply and effectively free borrowing costs following the COVID-19 pandemic resulted in irrational exuberance and aggressive capital allocation decisions that no longer work in this new era of debt costs.

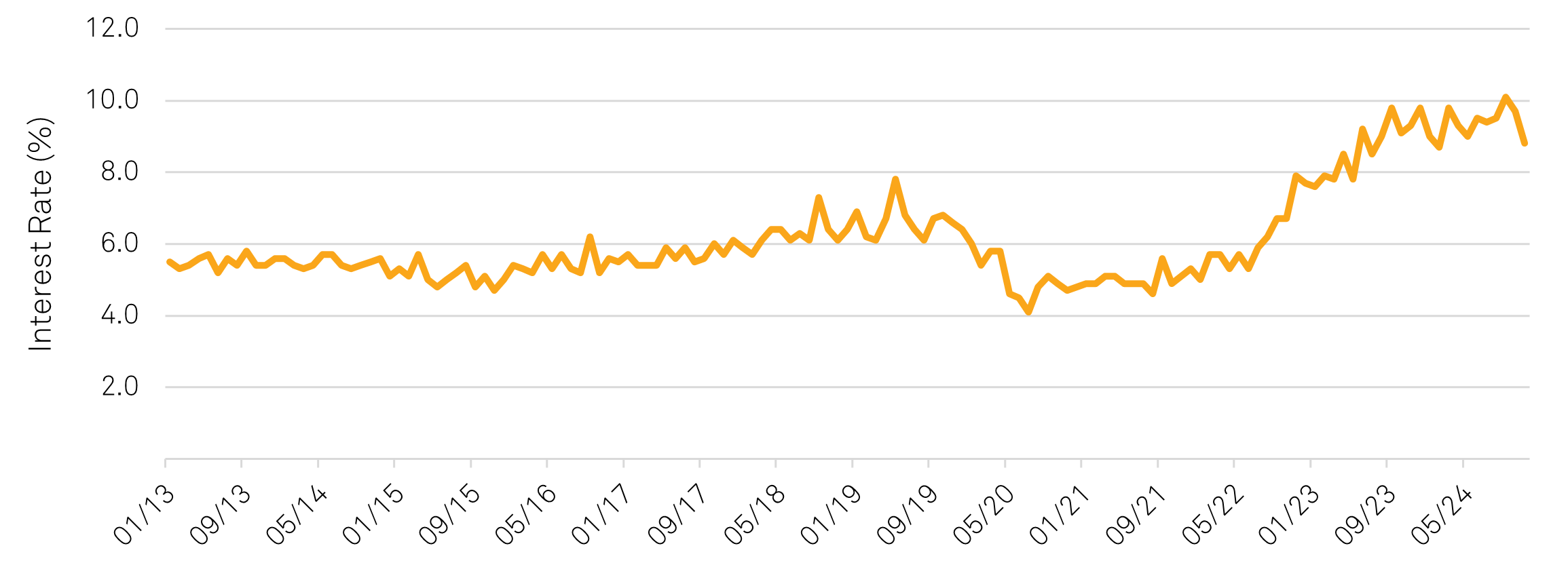

While many large businesses took advantage of low interest rates to fix long-term debt at favorable borrowing costs, the same cannot be said for small businesses that utilize short-term credit to fund spending. In fact, these small businesses are facing borrowing costs unlike what they have experienced in their recent histories (Figure 4). While the decrease in short-term rates should provide some reprieve, it will not be nearly as meaningful as was expected even six months ago. Additionally, capital providers are becoming more discerning – with capital no longer free, the hurdle to deploy capital has increased. Together, this is likely to result in the survival of the fittest. Those businesses that were not disciplined in their capital allocation decisions will be unable to survive in today’s reality. Meanwhile, those that were disciplined will not only have the capacity to survive but also the opportunity to gain share from those that fail.

Figure 4: Average short-term interest rates for small businesses

Source: NFIB and Bloomberg, as of January 8, 2025. Series NFIB Small Business Actual Average Interest Rate Pain on Short-term Loans SA.

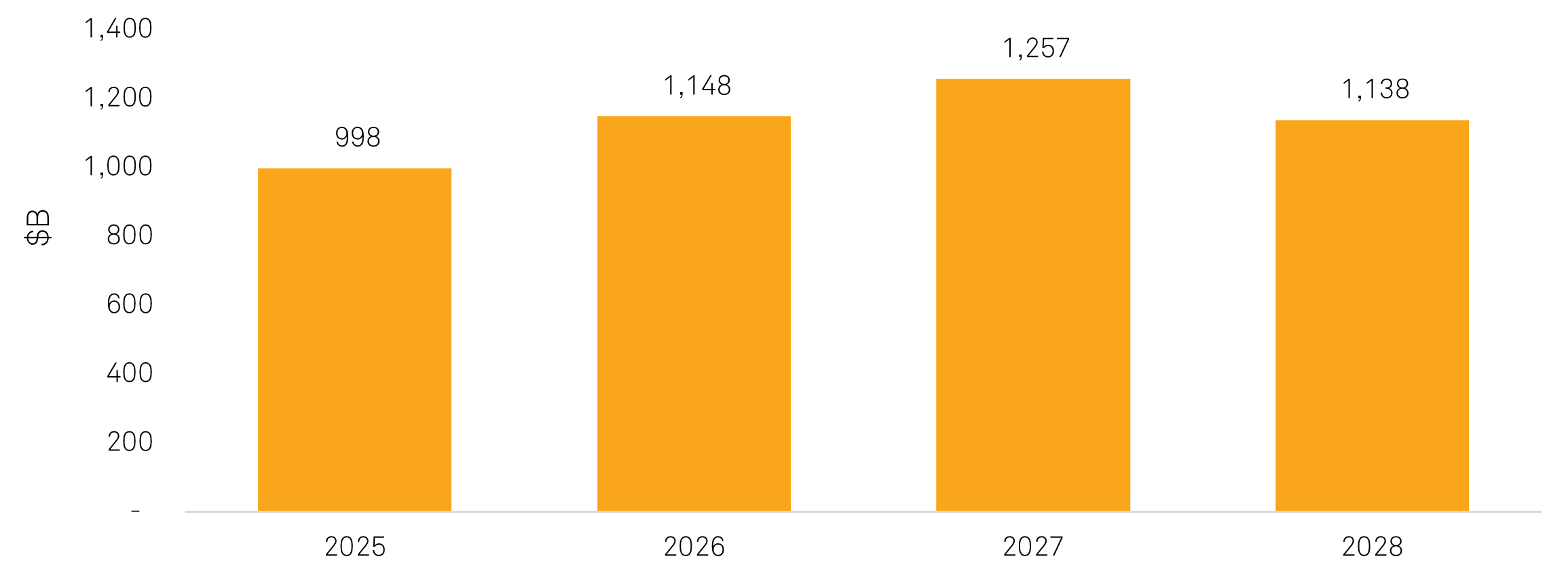

This phenomenon is especially true in the real estate sector. The latest data indicate that nearly $1 trillion in commercial real estate mortgages are expected to expire in 2025 (Figure 5). However, the actual figure is likely greater. Many debt maturities from 2023 and 2024 were extended in the hopes of lower interest rates providing an easier way out for real estate owners facing refinancing risk, as aggressive underwriting assumptions and lofty valuations gave way to capital stacks that simply do not work in today’s interest rate environment. While lenders have been patient in working with borrowers, we anticipate the broad-based acceptance of this new era of interest rates will prevent lenders from continuing to extend maturities and modify loan terms, forcing the unwinding of aggressive capital decisions that were made in the last five years.

Figure 5: U.S. commercial real estate mortgage expirations

Source: S&P Global, as of August 19, 2024. Data aggregates 3.6M commercial real estate mortgages, with missing dates estimated using a random forest model. Data gaps had minimal impact on results.

Not only will this provide investors with accretive acquisition opportunities, but it should also catalyze an increase in transaction activity and lead to rational price discovery in relation to the elevated cost of debt. While cap rates across core private real estate (using the NCREIF ODCE Index as a proxy) have increased 95 basis points since the first quarter of 2022, they have not expanded nearly enough to account for prevailing debt costs. For example, the latest appraisal cap rate1 across ODCE funds is just 4.68%, compared to the current 10-year treasury yield of…4.68%2. Historically, appraisal cap rates across ODCE funds have been at a 164 basis point spread to the 10-year treasury yield. If the 10-year treasury yield remains above 4%, appraisal cap rates would need to expand to at least 5.5% to compensate investors in line with historical levels. The lack of further cap rate correction on appraisals has been frequently attributed to the lack of comparable transactions to use for a guide on valuations. However, if the upcoming wall of debt maturities does spur transaction activity as we anticipate, valuations will be forced to align with some level of rationality, resetting valuations in earnest and beginning a new real estate market cycle.

Investing in real estate in the year ahead

Given the uncertainty around economic growth expectations, this new era of debt costs, and the valuation correction that should continue, our upcoming outlook pieces will dive further into areas where we believe investors can find the most compelling risk-adjusted returns across:

- Global Listed REITs - Sectors and regions poised for outperformance.

- Private Equity Real Estate – Niche property types where we, not capital markets, control our destiny and opportunistic acquisitions brought on by the unwinding of aggressive business plans.

- Private Real Estate Debt – High-quality income collateralized by strong rental housing assets in need of reconstituting their capital stack as debt matures.

Real estate markets thrive on resilience and adaptability—2025 marks a pivotal moment for disciplined investors to seize opportunities and shape the future amidst uncertainty.

General Disclosures

Any statement of opinion constitutes only the current opinion of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.

Material in this publication is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security or commodity. Due to, among other things, the volatile nature of the markets and the investment areas discussed herein, investments may only be suitable for certain investors. Parties should independently investigate any investment area or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. Some information contained herein has been obtained from third party sources and has not been independently verified by CenterSquare Investment Management LLC (“CenterSquare”). CenterSquare makes no representations as to the accuracy or the completeness of any of the information herein. Accordingly, this material is not to be reproduced in whole or in part or used for any other purpose. Investment products (other than deposit products) referenced in this material are not insured by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by CenterSquare, and are subject to investment risk, including the loss of principal amount invested.

For marketing purposes only. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person.

Any indication of past performance is not a guide to future performance. The value of investments can fall as well as rise, so investors may get back less than originally invested.

Because the investment strategies concentrate their assets in the real estate industry, an investment is closely linked to the performance of the real estate markets. Investing in the equity securities of real estate companies entails certain risks and uncertainties. These companies experience the risks of investing in real estate directly. Real estate is a cyclical business, highly sensitive to general and local economic developments and characterized by intense competition and periodic overbuilding. Real estate income and values may also be greatly affected by demographic trends, such as population shifts or changing tastes and values. Companies in the real estate industry may be adversely affected by environmental conditions. Government actions, such as tax increases, zoning law changes or environmental regulations, may also have a major impact on real estate. Changing interest rates and credit quality requirements will also affect the cash flow of real estate companies and their ability to meet capital needs.

This communication is not an offer of securities for sale in the United States, Australia, Canada, Japan or any other jurisdiction where to do so would be unlawful. CenterSquare has not registered, and does not intend to register, any portion of the securities referred to herein in any of these jurisdictions and does not intend to conduct a public offering of securities in any of these jurisdictions. This communication is being distributed to, and is directed only at, persons in the United Kingdom in circumstances where section 21(1) of the Financial Services and Markets Act 2000 does not apply (such persons being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. Any investment activity (including, but not limited to, any invitation, offer or agreement to subscribe, purchase or otherwise acquire securities) to which this communication relates will only be available to, and will only be engaged with, persons who fall within the target market. This communication is an advertisement and is not a prospectus for the purposes of Directive 2003/71/EC, as amended (such directive, the “Prospectus Directive”) and/or Part IV of the Financial Services and Markets Act 2000.

Any communication of this document by a person who is not an authorized person (as defined in the Financial Services and Markets Act 2000 (“FSMA”)) is directed only at the following persons in the United Kingdom, namely (i) persons falling within any of the categories of “investment professionals” as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Financial Promotion Order”), (ii) persons falling within any of the categories of persons described in Article 49(2) of the Financial Promotion Order, (iii) persons falling within the categories of “certified high net worth individual” described in Article 48(2) of the Financial Promotion Order and “self-certified sophisticated investor” described in Article 50a(1) of the financial promotion order and (iv) any person to whom it may otherwise lawfully be made. Persons of any other description should not review, nor act upon, this document.

For the purposes of Article 19 of the Financial Promotion Order, this document is directed at persons having professional experience in matters relating to investments. Any investment or investment activity to which this document relates is available only to such persons. Persons who do not have professional experience in matters relating to investments (and in respect of whom another exemption is not available) should not rely on this document.

For the purposes of Article 49 of the Financial Promotion Order, this document is directed at persons meeting the respective minimum criteria specified in Article 49(2) of the Financial Promotion Order (for example, partnerships with net assets of not less than £5 million). Any investment or investment activity to which this document relates is available only to such persons. Persons who do not meet such minimum criteria (and in respect of whom another exemption is not available) should not rely on this document.

Canada Specific Disclosures

This document has been prepared solely for information purposes and is not an offering memorandum nor any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation, investment advice or invitation to trade. This information is confidential and for the use of the intended recipients only. The distribution of this document in Canada is restricted to recipients who are qualified “permitted clients” for purposes of NI31-103. This document may not be reproduced, redistributed or copied in whole or in part for any purpose without prior written consent.

CenterSquare REIT Cap Rate Perspective Methodology

CenterSquare REIT Implied Cap Rates are based on a proprietary calculation that divides a company’s reporting net operating income (“NOI”) adjusted for non-recurring items by the value of its equity and debt less the value of non-income producing assets. The figures above are based on Q3 2024 earnings reported in June 2024.

The universe of stocks used to aggregate the data presented is based on CenterSquare’s coverage universe of approximately 200 U.S. listed real estate companies. Sector cap rates are market cap weighted. Sectors and market classifications are defined by the following:

Apartment: REITs that own and manage multifamily residential rental properties; Industrial: REITs that own and manage industrial facilities (i.e. warehouses, distribution centers); Office – REITs that own and manage commercial office properties; Retail – REITs that own and manage retail properties (i.e. malls, shopping centers); Hotel – REITs that own and manage lodging properties; Healthcare – REITs that own properties used by healthcare service tenants (i.e. hospitals, medical office buildings); Gateway – REITs with portfolios primarily in the Boston, Chicago, LA, NYC, SF, and DC markets; Non-Gateway – REITs without a presence in the gateway markets.

The REIT ODCE Proxy is a universe of REIT stocks built to resemble the NCREIF Fund Index – Open End Diversified Core Equity (ODCE). The ODCE, short for NCREIF Fund Index - Open End Diversified Core Equity, is the first of the NCREIF Fund Database products and is an index of investment returns reporting on both a historical and current basis the results of 36 open-end commingled funds pursuing a core investment strategy, some of which have performance histories dating back to the 1970s. The REIT ODCE Proxy is proprietary to CenterSquare and uses gateway/infill names in apartments, retail, industrial and office, and then weights them according to the ODCE index to create a proxy.

Private Market Cap Rates represent the cap rate achievable in the private market for the property portfolio owned by each company, and are based on estimates produced by CenterSquare’s investment team informed by various market sources including broker estimates.

Any statement of opinion constitutes only current opinions of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.