2025 Private Real Estate Debt Outlook – Unlocking the Gap Capital Opportunity

March 2025

UNLOCKING THE GAP CAPITAL OPPORTUNITY

2025 PRIVATE REAL ESTATE DEBT OUTLOOK

While the “higher for longer” interest rate environment has presented headwinds across the commercial real estate industry, nowhere has it created as much opportunity as we see within real estate credit strategies. Specifically, we see the best risk-adjusted returns in two areas: value-add and gap capital opportunities. This second area focuses on filling the void created by the nearly $1 trillion in debt maturing in the coming year, leaving borrowers little choice but to seek replacement capital at higher costs. Within this opportunity set, we view certain sectors more favorably than others, in particular, rental housing.

Lending conditions in an uncertain real estate market environment

Our experience investing through several cycles has taught us that loans made during times of dislocation have greater potential to outperform those made during more stable periods. Looking into 2025, we see this type of dislocation driven by the impact of higher interest rates following four decades of a secular decline in rates, as we outlined in our macro outlook. The resulting uncertainty in real estate valuations is likely to continue until transaction volumes increase enough to provide the marketplace with reliable appraisal data. We anticipate this will be driven by the debt markets this year in earnest.

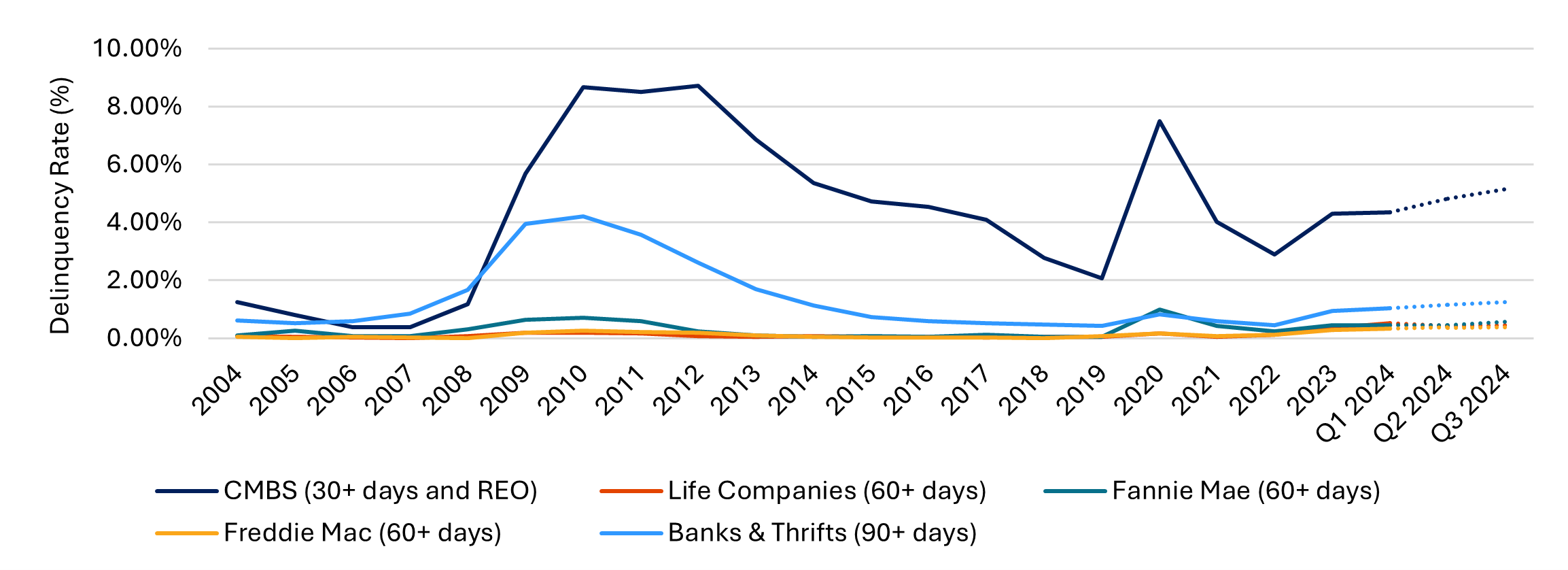

For nearly two years, the commercial real estate industry has been watching the “wall of debt maturities” in the asset class. However, despite these elevated levels of debt maturities amidst a historic increase in interest rates, transactions remained muted as lenders and sponsors were willing to modify loan terms and extend maturities in the hopes of lower interest rates being the panacea for capital stacks that no longer work in the higher interest rate environment. In turn, delinquencies remained surprisingly low (Figure 1). Today, we seem to be entering an environment where broader market acceptance of this “higher for longer” interest rate environment is changing behaviors. Not only are market participants less optimistic about the short end of the yield curve coming down from monetary policy decisions, but acknowledgement is also increasing that the long end of the yield curve is likely to remain elevated as a normal yield curve structure returns to the market. Broadly, lenders are less likely to extend and modify terms on loans maturing this year, totaling nearly $1 trillion, spurring transaction volumes that will provide rational price discovery.

Figure 1: Historical commercial/multifamily mortgage delinquency rates

Sources: Mortgage Bankers Association, as of Q3 2024.

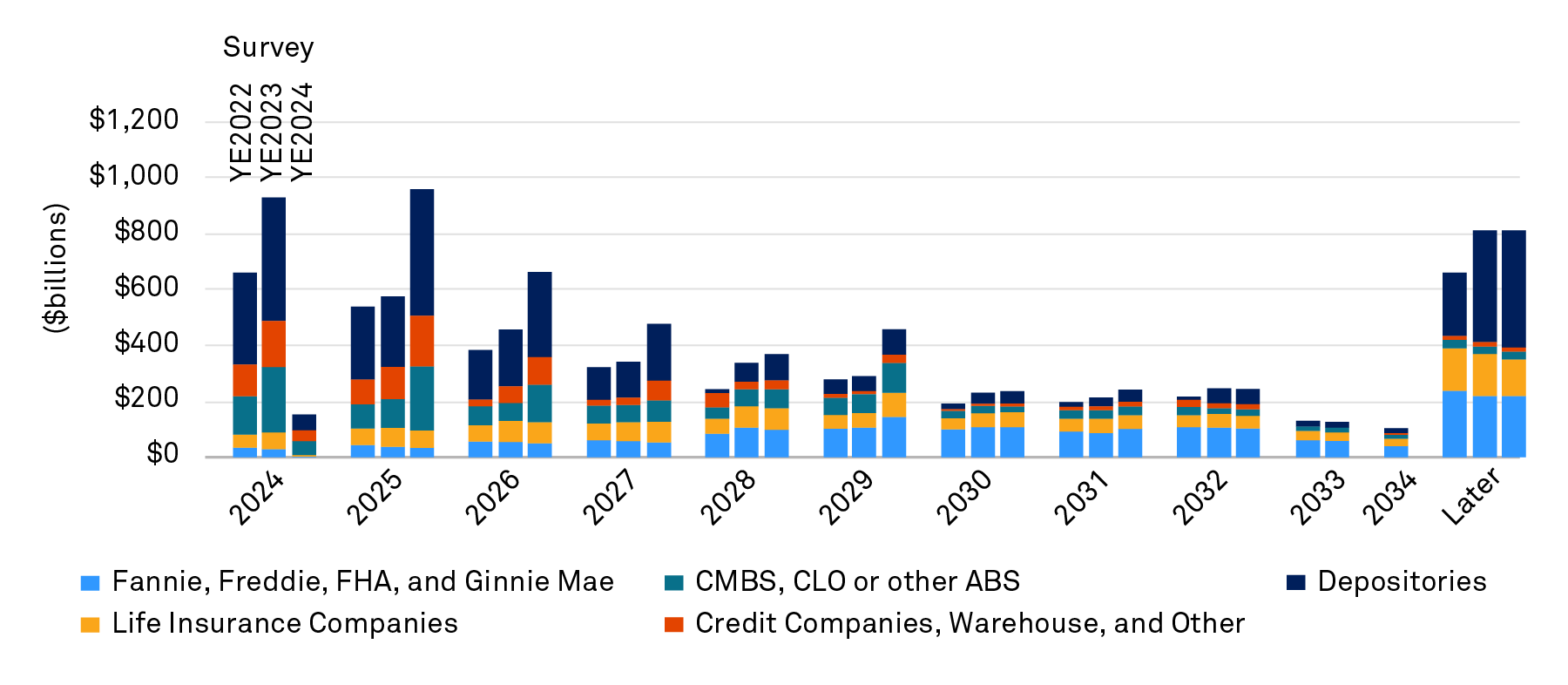

This elevated demand is going to be met with a continued lower supply of new debt capital from traditional sources. Regional banks have greatly curtailed their origination capabilities until (presumably) they can clear legacy loans from their balance sheets. Leveraged lenders such as debt funds that rely on repo financing are no longer as competitive given their own cost of financing. CMBS lenders, while increasing their activity of late, remain beholden to the whims of the public bond markets. Insurance companies remain somewhat active, but are focused on stabilized, low-leverage assets. In this environment, private lenders are well positioned to pick and choose their areas of focus and are largely expected to fill some of the void resulting from this supply/demand imbalance over the next several years as over $2 trillion in loans are expected to mature through 2027 (Figure 2).

Figure 2: Commercial real estate loan maturity volumes

Sources: Mortgage Bankers Association Commercial Real Estate Survey of Loan Maturity Volume, as of February 21, 2025. The above data includes forward looking information, actual results may be materially different.

As this maturing debt unwinds through the system, capital stacks will have to be reconstructed as valuations are resetting, generating an attractive entry point in the real estate cycle to lend against high-quality real estate at a lower basis while capturing major demographic trends across select property types. Further, the recovery of the real estate cycle and more normalized capital markets in 2026 and beyond will provide attractive exit opportunities in the future.

In these circumstances, we anticipate private real estate debt opportunities will fall into one of two general categories. The first, which we don’t believe to be as appealing, involves assets that are truly distressed, where the underlying use is largely obsolete and the assets need a major repositioning or overhaul. The second category, which offers what we believe to be the most attractive risk/reward proposition for private real estate debt investors in the coming year, includes both value-add and gap capital opportunities. Here, given downward pressure on underlying property values, many assets are struggling to find replacement financing or are merely over-leveraged. For credit providers with discipline and a deep understanding of real estate and asset values, this offers an opportunity to play a role in the healthy reconstitution of the borrower’s capital stack. The gap capital opportunity, in particular, screens attractive as it allows investors to fill the void in the capital structure of assets that are either largely or fully stabilized, generating loans with better attachment points, lower loans-to-value (using a reset “value”) and strengthened covenants, secured by assets with little to no execution risk.

Rental housing focus

We believe that, although the market presents a favorable backdrop for real estate debt investors, certain asset classes and strategies will demonstrate significantly less volatility than others. Given this dynamic, and our desire to capture the optimal risk/reward proposition, we anticipate the strongest investments will be those secured by the most durable cash flow-generating, high-quality assets – such as rental housing – to borrowers that employ the most predictable strategies (value-add and gap capital/largely stabilized). Across the rental housing sector, certain subsectors are best positioned to capture strong fundamentals, such as multifamily, student housing, and active adult.

Multifamily

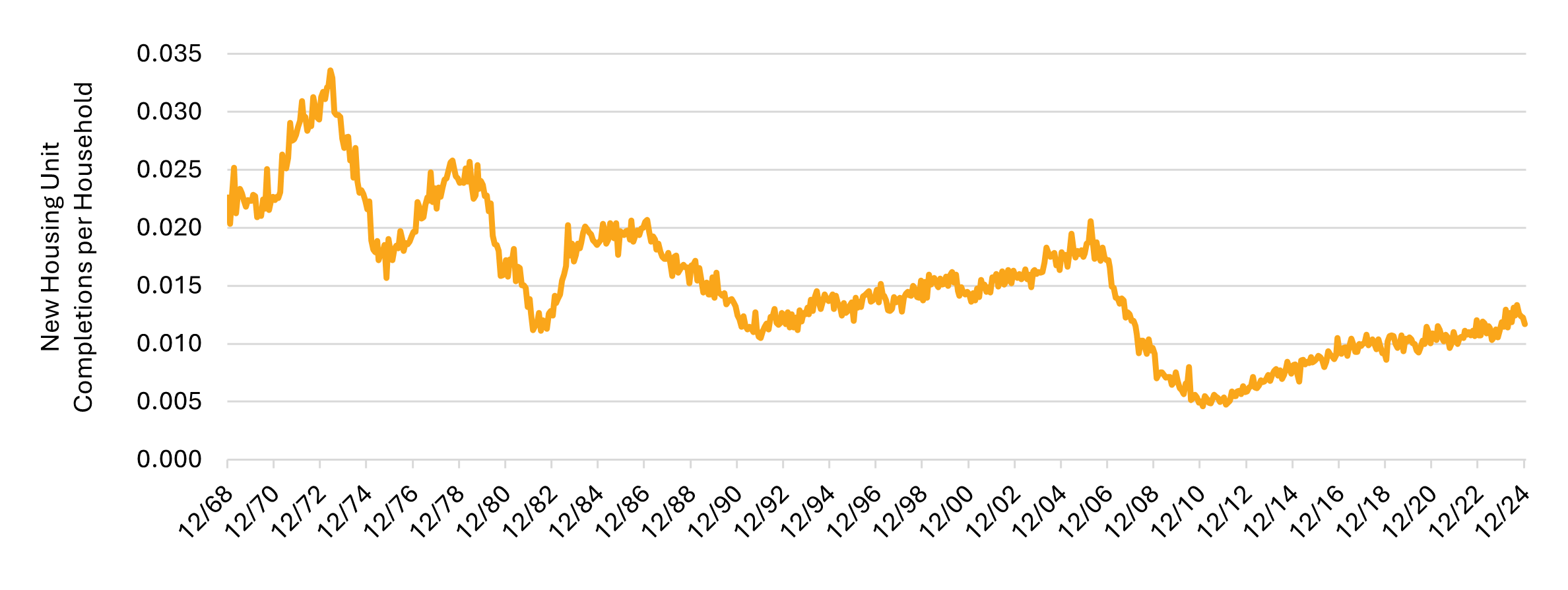

Although multifamily supply in certain cities (e.g. Austin, Phoenix, Nashville) has significantly outpaced demand in the last 12-18 months, the U.S. housing market remains structurally undersupplied, particularly so from a moderate-income housing perspective. Overall, supply has not kept pace with the rate of population growth and household formation over the last economic cycle (Figure 3).

Figure 3: New housing completions per household

Sources: Federal Reserve Bank of St. Louis, FRED Economic Data, as of December 2024.

In recent years, new deliveries have certainly approached the annual need, but largely in high-velocity, sunbelt cities at high price points. This supply/demand imbalance on a national level is likely to persist, and the shortage is likely to become even more acute as new construction starts have fallen precipitously, due to the prohibitively higher financing costs and elevated cost of construction. The housing shortage is further exacerbated when taking into account the considerable growth in the cost of home ownership. The average 30-year mortgage rate remains near 7%, insurance and maintenance costs are rising significantly, and home prices remain well above pre-COVID levels, requiring down payments and monthly payments that are unaffordable for much of the U.S. population. This dynamic will likely continue to drive rental housing demand for years to come.

Student housing

While the broader rental housing market is primed to benefit from strong fundamentals driven by a supply and demand imbalance, certain niche subsectors are poised to benefit from other unique fundamental drivers. The student housing subsector, for example, has evolved dramatically over the last decade as student preferences have changed. What used to be a dormitory-style product has evolved into an amenity-rich product preference more like institutional-quality multifamily.

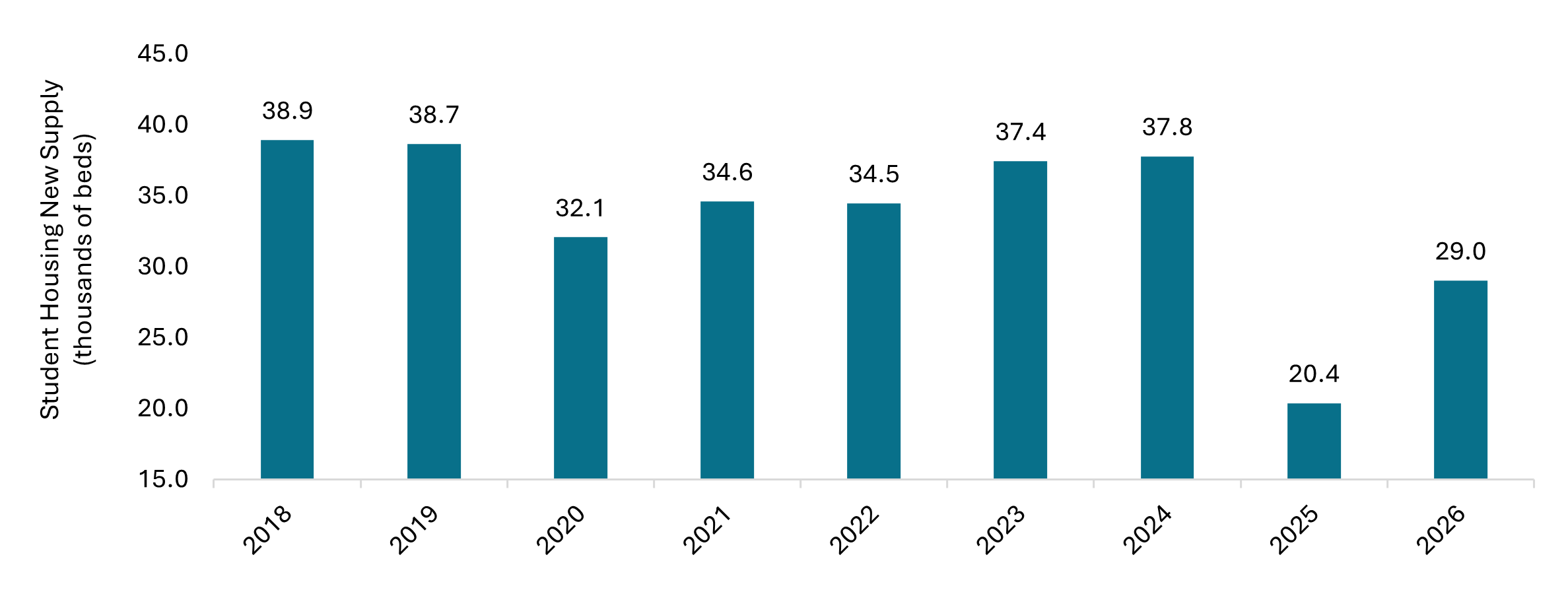

In top-tier markets, the lack of availability of this product, combined with a captive pipeline of demand through steady and growing enrollment, is creating a supply and demand imbalance. In fact, the top 20 markets by inventory average 1.34 students to every bed, demonstrating the shortage of student housing in these markets as schools continue to grow enrollment with the return of international students post-COVID and smaller schools lose enrollment market share. Furthermore, development activity is being meaningfully curtailed as developers across this subsector, similar to traditional multifamily, are finding it difficult to finance in the face of elevated construction and capital costs (Figure 4). These dynamics are leading to continued rental rate growth in top-tier student housing markets.

Figure 4: Off-campus student housing supply

Sources: Berkadia 2024 U.S. Student Housing Pipeline Report, published November 5, 2024. The above data includes forward looking information, actual results may be materially different.

Active adult

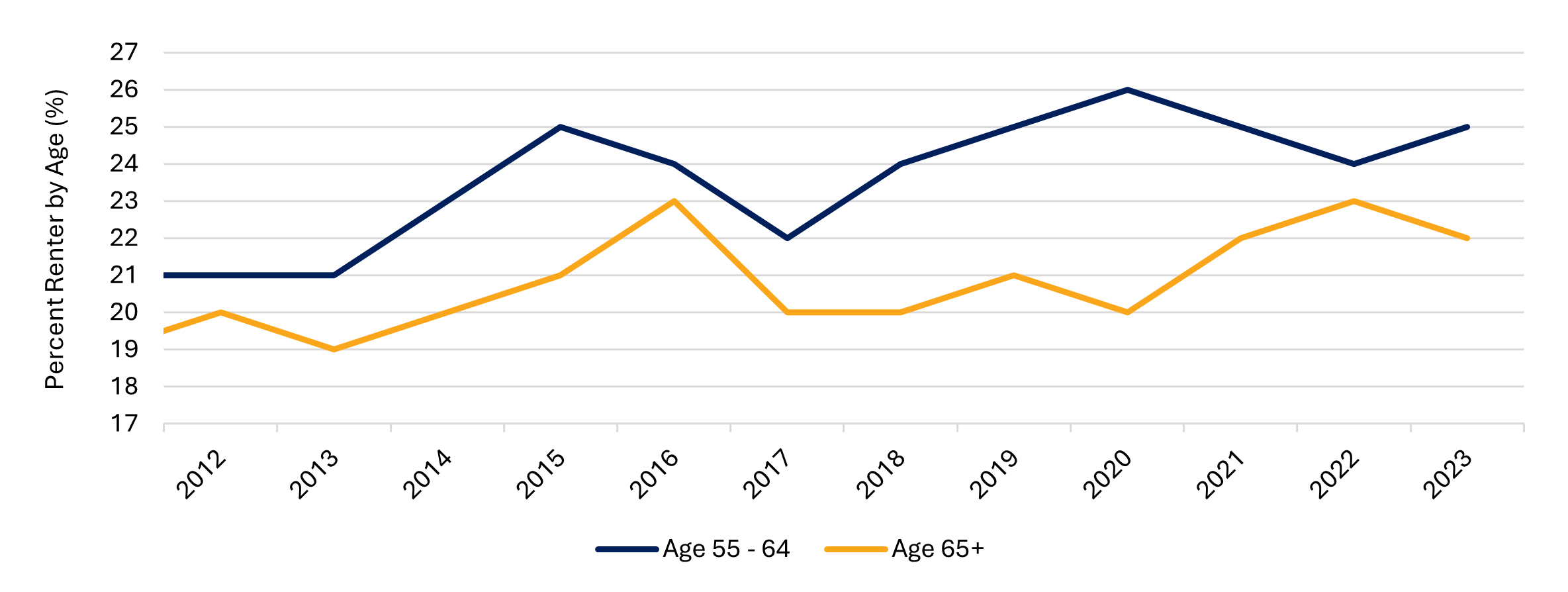

Elsewhere, the active adult subsector is an emerging property type catering to one of the most meaningful demographic tailwinds impacting the U.S. – the aging of the Baby Boomer generation, which holds over half the country’s net wealth. These properties typically serve the 55+ age cohort that wants to live in a multifamily setting with other residents of a similar age but who are more independent and active than the typical resident in a more traditional senior housing facility. The demand for active adult living has grown in the last decade, particularly for those over the age of 55 choosing to rent (Figure 5). Further, an additional 2.2 million adults over the age of 65 are expected to consider becoming renters in the coming decade per data from NIC. Due to the stickier nature of the tenancy across these properties, active adult assets tend to experience lower turnover and be occupied by wealthier adults, creating high-credit stable cash flows at the property level.

Figure 5: Percent renter by age 55+

Sources: Federal Reserve Bank of St. Louis, FRED Economic Data, as of January 2023.

Against the backdrop of a resetting market, private real estate debt stands out as a shelter from the storm. As transaction volumes continue to stall and valuations inch toward rational levels, private real estate debt, particularly when secured by cash flow generating, high-quality assets such as we see in certain rental housing subsectors, provides an attractive risk/return investment opportunity in a market still rife with uncertainty.

As nearly $1 trillion in debt matures, who will step in to bridge the gap and seize the opportunity?

General Disclosures

Any statement of opinion constitutes only the current opinion of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.

Material in this publication is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security or commodity. Due to, among other things, the volatile nature of the markets and the investment areas discussed herein, investments may only be suitable for certain investors. Parties should independently investigate any investment area or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. Some information contained herein has been obtained from third party sources and has not been independently verified by CenterSquare Investment Management LLC (“CenterSquare”). CenterSquare makes no representations as to the accuracy or the completeness of any of the information herein. Accordingly, this material is not to be reproduced in whole or in part or used for any other purpose. Investment products (other than deposit products) referenced in this material are not insured by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by CenterSquare, and are subject to investment risk, including the loss of principal amount invested.

For marketing purposes only. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person.

Any indication of past performance is not a guide to future performance. The value of investments can fall as well as rise, so investors may get back less than originally invested. Because the investment strategies concentrate their assets in the real estate industry, an investment is closely linked to the performance of the real estate markets. Investing in the equity securities of real estate companies entails certain risks and uncertainties. These companies experience the risks of investing in real estate directly. Real estate is a cyclical business, highly sensitive to general and local economic developments and characterized by intense competition and periodic overbuilding. Real estate income and values may also be greatly affected by demographic trends, such as population shifts or changing tastes and values. Companies in the real estate industry may be adversely affected by environmental conditions. Government actions, such as tax increases, zoning law changes or environmental regulations, may also have a major impact on real estate. Changing interest rates and credit quality requirements will also affect the cash flow of real estate companies and their ability to meet capital needs.